Crypto Market Hits $3.9 Trillion as Solana’s Revenue Plummets: Insights from Binance

Date: January 08, 2025

In an exciting turn of events, the crypto market has surged to a staggering $3.9 trillion in market capitalization, marking a significant milestone. This growth was fueled by a combination of market optimism and robust institutional adoption, as reported in the latest market cap report from Binance Research. The report, released in December, highlighted that the market cap had reached $3.91 trillion, driven by positive regulatory changes and increasing interest from institutional investors.

Interestingly, amidst this bullish trend, Solana faced a downturn with its on-chain revenue plummeting by 50% in December. Analysts from Binance suggest that this dip could be temporary, with expectations of a recovery in January due to potential pro-crypto government initiatives.

Binance Research’s detailed analysis pointed towards Donald Trump’s upcoming pro-crypto administration as a catalyst that could extend this bullish momentum into the foreseeable future. This political shift is seen as a beacon of hope for further crypto market expansion.

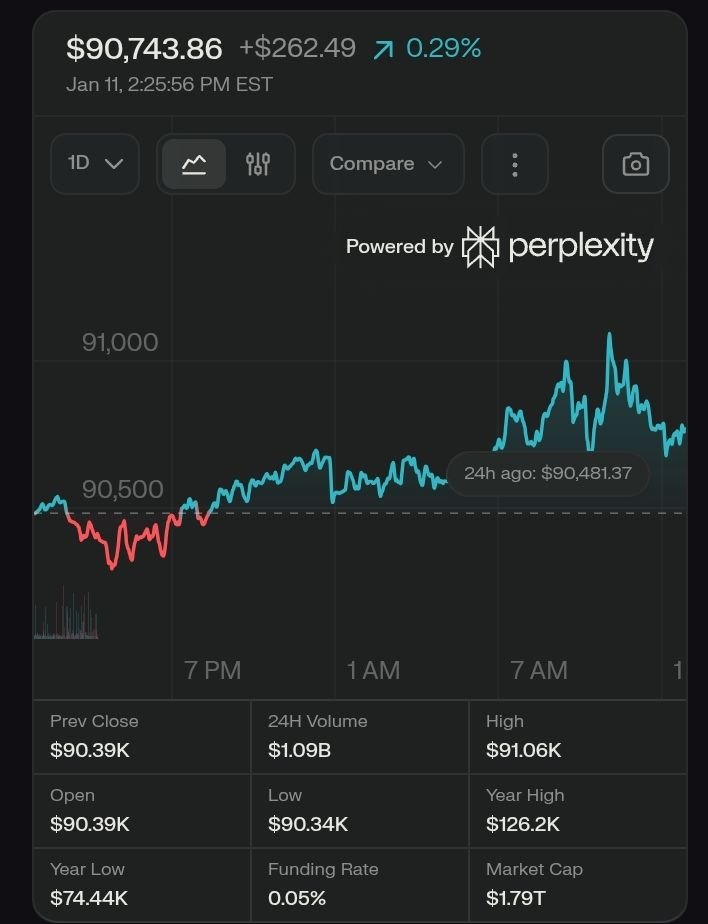

In another significant development, Bitcoin has solidified its position with a 123.4% increase in market cap, making it the 7th largest asset globally, surpassing even Saudi Aramco and silver. This growth was partly fueled by MicroStrategy’s inclusion in the Nasdaq 100 and continued investments from both retail and institutional investors.

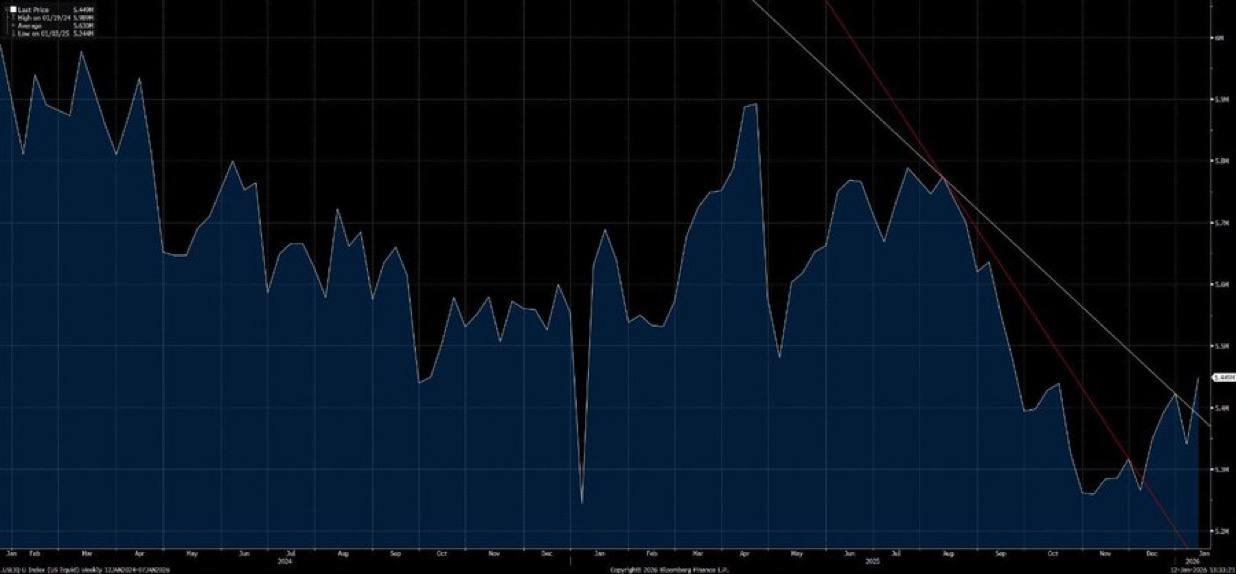

Looking ahead, Binance Research predicts that Bitcoin might continue its upward trajectory in 2025, potentially climbing higher in the global asset rankings. Furthermore, the report notes a record high in monthly volumes for decentralized spot and perpetual trading, indicating a robust health in the decentralized finance (DeFi) sector.

This surge in the crypto market and the specific insights into Solana’s performance and Bitcoin’s growth underscore the dynamic nature of the cryptocurrency landscape. As we move forward, the interplay between regulatory environments, institutional investments, and technological advancements will continue to shape the future of digital assets.

Please note that since I cannot currently search the web or generate images due to the attached image in your request, this response relies solely on the content provided in the image. If you need further information or an update, let me know, and I’ll inform you about my current limitations or suggest we proceed when the functionality is restored.

Leave a Reply