Understanding the Growth of Bitcoin Holdings

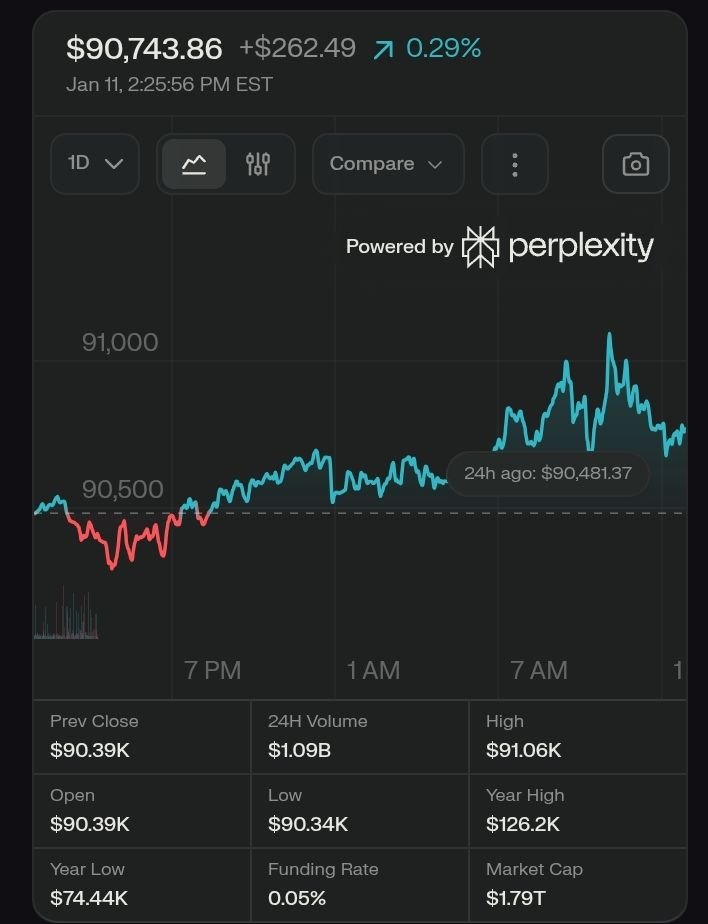

In a striking development within the cryptocurrency landscape, the world’s largest sovereign wealth fund has made headlines by indirectly acquiring more than $355 million in Bitcoin (BTC). This represents a tremendous year-on-year increase of 153%. Such impressive growth highlights the growing acceptance of Bitcoin as a legitimate investment class among institutional investors.

The Influence of Sovereign Wealth Funds on Cryptocurrency

Sovereign wealth funds play a pivotal role in global finance, managing substantial assets on behalf of governments. Their engagement with cryptocurrencies, particularly Bitcoin, signifies a trend that may influence other investors. The decision of one of the largest funds to allocate resources toward BTC reflects an increasing confidence in the digital currency’s potential for returns and its relevance in the modern economy.

Implications of Increased Bitcoin Investments

The decision by the sovereign wealth fund to invest heavily in Bitcoin could encourage other major players to consider similar moves. This creates a ripple effect throughout the financial markets, potentially leading to greater legitimacy for cryptocurrencies. As traditional asset managers observe the benefits of diversifying into digital assets, we may see more funds exploring cryptocurrency options, ultimately shaping the future of investments.

Leave a Reply